Guest blog post regarding IR35 legislation and what it means for you.

IR35 legislation was introduced in 2000 as a means to prevent people taking advantage of independent contractor status for tax gains. Despite having been around more than a decade it is still confusing people and catching them out. With over 2000 investigations being launched in 2012 alone it is something that HMRC take very seriously.

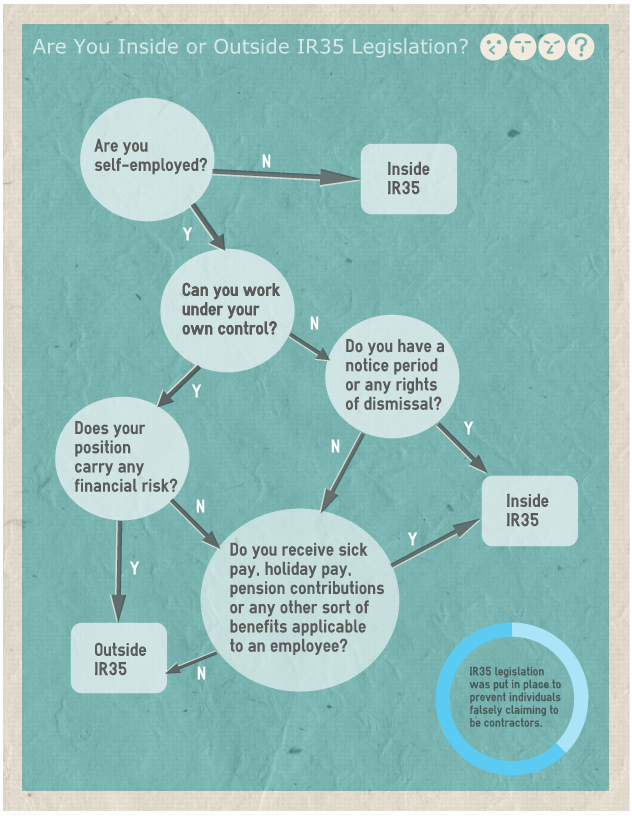

IR35 is essentially a set of guidelines HMRC use to decide whether a person pays regular PAYE and NI tax contributions like an employee or corporation tax like an independent entity. The guidelines establish whether a contractor is truly independent by considering a number of factors. So knowing whether you are “inside” IR35 (an employee) or “outside” IR35 (independent) is very important. This flow chart should give you a basic idea of what HMRC will be looking for:

Infographic supplied by The Accountancy Partnership

Now, where this gets complicated for self-employed contractors, is that from job to job the contracts you enter into may cross the line between being “inside” and “outside” IR35. Employment lawyers or contractor accountants can offer advice on this subject but it is wise to look over any contract you enter into with IR35 guidelines at the forefront of your mind.

To be truly outside IR35 you will typically be:

– Paid a specific amount for one job

– Be financially responsible for the jobs completion, quality and timescale

– Have complete control of the job (i.e. no immediate boss)

– Provide your own tools, equipment and resources for the job

– Without sick pay, pension contributions, or other benefits.

If none of the above attributes apply to you then HMRC will likely rule that you are an “employee” and due to pay regular rates of PAYE and NI.

If an IR35 investigation is brought against you and you are found guilty then you can be fined anything from 30-100% of the total tax due.